There are many different metrics investors can use to estimate the profitability of investments such as real estate. One of the most prominent metrics is the internal rate of return, or IRR.

There are many different metrics investors can use to estimate the profitability of investments such as real estate. One of the most prominent metrics is the internal rate of return, or IRR.

The IRR estimates the annual rate of growth that an investment will generate. It is a discount rate, which means investors can use it to help determine the value of an investment today based on projections of the amount of money it will generate in the future.

In more technical terms, the IRR is the annual growth rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. In other words, it makes the value of cash inflows equal to the initial net cash outlay for the investments. Unlike the ROI, which measures total growth from the beginning to the end of the investment, the IRR identifies the annual growth rate. Many investors prefer to use the IRR rather than ROI calculations, especially when researching long-term investments.

Why Do You Need to Care About the Internal Rate of Return?

In general, the higher the internal rate of return, the more desirable it is to make an investment. There are other factors to consider, such as the risk level of the investment, but all other things equal, you want to choose the option with the highest IRR. Having an IRR value also lets you calculate how much an investment is worth today and makes it easier to compare between different investments.

For example, let’s say you are considering an investment that is expected to be worth $1,000 a year from now. You want to know how much that investment is worth today. You can find out by estimating the IRR, the percentage your money will earn in annual returns, and using it to calculate the present value of the investment. If the IRR is 10%, then that investment projected to be worth $1,000 in a year is worth $909.09 today ($1,000 / 1.1).

As another example, let’s say you are comparing two similar properties. Property A has an IRR of 10%, while Property B has an IRR of 15%. It is most likely better to invest in Property B because its higher IRR means it is expected to generate a higher annual return.

What are the Benefits and Drawbacks of Using the IRR Formula?

Pros:

Pros:

- The IRR allows you to easily compare investments, even if those investments must be held for different lengths of time.

- The IRR includes several factors that are not included in the ROI.

Cons:

- The IRR is less common and more difficult to calculate than the ROI, although it has become much easier to calculate with computers.

- The IRR calculation assumes that dividends and cash flows are reinvested at the estimated discount rate, which doesn’t always happen. Sometimes it makes sense to use the modified internal rate of return instead.

How to Calculate the IRR

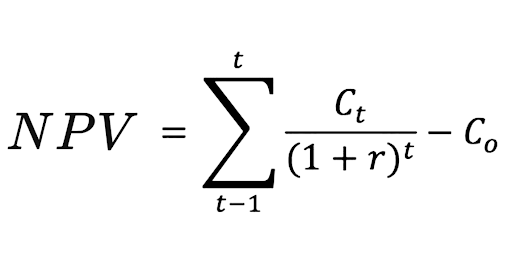

The IRR is the discount rate that makes the net present value of future cash flows equal to zero. The net present value (NPV) is the difference between the present value of future cash inflows and outflows over a period of time. You can calculate the IRR with a standard formula:

IRR Formula

where:

where:

- NPV = net present value

- t = number of time periods (years)

- Ct = net cash inflow during period t

- r = IRR or discount rate

- C0 = total initial investment cost/outlay

To find the IRR, you would set the NPV to zero and solve for r. The value of r when the NPV is 0 is the IRR. You can calculate the IRR through trial and error. However, it’s easiest to do with a computer or spreadsheet rather than by hand.

What is a Good IRR?

The ideal IRR depends on your goals as an investor, the cost of capital, and the opportunity costs you will incur. An investor looking to acquire a very low-risk, stabilized asset might seek an IRR of 10%, while a developer willing to take on more risk might seek an IRR of 20% or more. Many investors look for an IRR in the mid teens.

Learn More About Real Estate Investing On the CEP Blog

The IRR is an excellent metric for evaluating and comparing real estate investment options. To learn more about real estate investing terms and trends, including multifamily investments, we encourage you to check out the CEP blog or subscribe to our newsletter.