When evaluating real estate investment opportunities, it is critical to fully understand the importance of Net Operating Income (NOI).

NOI is a profitability formula often used in real estate to measure a commercial property’s profit potential and financial health by calculating the income after operating expenses are deducted. In other words, it measures the amount of cash flows that a property has after all necessary expenses have been paid.

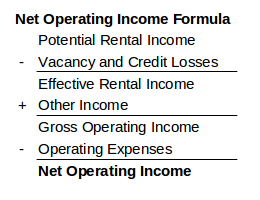

Net operating income is simply the annual income generated by an income-producing property after accounting for all income collected from operations, and deducting all expenses incurred from operating the property. For the purposes of real estate analysis, NOI can either be based on historical financial statement data, or instead based on forward-looking estimates for future years (also known as a proforma). The net operating income formula is as follows:

Real estate investors and creditors use this calculation to evaluate the cash flows of a specific property and determine whether it is a good investment or creditworthy. They also use this ratio to formulate an initial value of the property. For example, they look at how much money the property can generate after all the operating expenses have been paid in order to decide how valuable it is and what price they are willing to pay for it.

NOI and the Loan Amount

Net operating income is primarily used when determining profitability for real estate investments. When considering potential investments, NOI can be utilized by both investors and lenders. By looking at this indicator, lenders can judge whether the investor will make enough cash flow to make loan payments.

It is not uncommon for NOI to be used when sizing commercial loans for real estate investments. This is because lenders want to know whether investors will be able pay back the loan when considering the potential NOI the property produces. A lender will establish a minimum Debt Coverage Ratio (DCR) as a loan sizing constraint.

Debt Coverage Ratio (DCR) = NOI / Annual Debt Service Payment

The lender wants to keep the annual debt service payment below a certain percentage of the NOI to ensure that the borrower can safely service the debt from operating profits (NOI).

NOI and Investor Cash Flow

Net operating income measures the ability of a property to produce an income stream from its operation. It is important to note that NOI excludes any financing costs (principal and interest payments), income taxes, replacement reserves, or capital expenditures incurred by the owner/investor. In other words, the net operating income is unique to the property, rather than the investor.

NOI solely relies on expenses related to the property. The expenses used to calculate cash flow include those related to both the rental property and the real estate investor.

Investor Cash Flow = NOI – Debt Service, Income Tax, Capital Expenditures, etc.

This is the investor’s net income and represents the distributable cash that the investment generated.

NOI and Capitalization Rate

An asset’s net operating income can do more than determine its revenue potential; it can help investors determine another important variable: capitalization rate (cap rate) or potential rate of return.

Basically, the cap rate is the ratio of net operating income (NOI) to property value or sales price.

Cap Rate = Net Operating Income / Property Value

In other words, this ratio is a straightforward way to measure the relationship between the return generated by the property and the price of it. The cap rate of a subject property will simultaneously place an objective value on the asset and make it possible for the investor to compare dissimilar assets.

Example:

Subject Property NOI = $1,500,000

Sale Price = $25,000,000

CAP Rate = NOI/Market Value (or $1.5M/$25M) = 6.00%

Alternative Property NOI = $1,000,000

Sale Price = $20,000,000

Cap Rate = $1.0M/$20M = 5.00%

If all else is equal, a property with a 6% cap rate versus another property’s 5%, an investor is most likely to focus on the property with a 6% cap rate.

How Does This Impact Real Estate Investment Strategy?

Calculating NOI is an important step in evaluating and valuing a property. Once you have an NOI figure, you can begin looking at various measures such as the Cap Rate. Then you can also move on to a more detailed analysis that includes an investor cash flow figure and a lender debt coverage ratio.

Keep the above NOI formula in mind when calculating and reviewing NOI figures and be aware of what’s included and excluded from NOI, and you’ll have a good framework for understanding net operating income for any property and how to use NOI effectively in other important investment calculations.