If you spend enough time learning about real estate investing, you’re bound to come across the term “debt-service coverage ratio” (DSCR) or “debt coverage ratio” (DCR). Just like with other financial terms, it’s a good idea to make sure you know what it means before you make any investment decisions.

Within the real estate industry, DSCRs are used to qualify for financing from a bank or lender. Let’s take a closer look at this metric and how it may affect your real estate investment decisions.

What is Debt-Service Coverage Ratio in Real Estate?

Debt-service coverage ratio (DSCR), or debt coverage ratio (DCR), is an important metric that may impact your real estate investment decisions. It measures the cash flow a real estate company has available to pay current debt obligations. In short, it shows whether the company can pay its debts.

Real estate investors use the DSCR to analyze projects, firms, or individual borrowers before making an investment. Commercial lenders use it to determine the maximum loan amount and whether the debt a property is incurring is sustainable. Typically lenders are more forgiving of lower DSCRs when the economy is growing.

Why DSCRs change over time

Debt service coverage ratios typically change over time because of changes in the property’s performance. If the NOI goes up, such as through increasing rental income, the DSCR increases. If the NOI decreases, such as through rising operating expenses, the DSCR drops.

Sometimes lenders will look at models showing the DSCR over time. This makes it easier to see whether the most recently calculated DSCR was a fluke, and also to identify when periods of weak cash flow are likely to occur.

How Do You Calculate Debt Coverage Ratio?

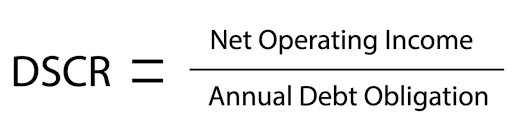

To calculate the debt coverage ratio, you need to know the real estate company or entity’s net operating income and annual debt obligation.

The net operating income, also known as the Earnings Before Interest and Tax (EBIT), is the entity’s revenue after taking out operating expenses. Taxes and interest are not included in this number. The annual debt obligation includes any amount of principal, interest, sinking funds, and lease payments that are due within a year.

You can use this simple formula to calculate the DSCR:

To give you an example of a DSCR calculation, let’s say a real estate developer has a net operating income of $1 million per year. Their annual debt obligation is $800,000. Using the formula, this means the DSCR is calculated as $1,000,000 / $800,000, or 1.25x.

As another example, let’s say a developer has a net operating income of $500,000 per year and an annual debt obligation totalling $350,000 per year. Their DSCR would be calculated as $500,000 / $350,000, or roughly 1.43x.

Typically, the DSCR is shown as a number followed by x. This is because the DSCR represents the number of times the asset can cover its debt in a given year. If a property’s DSCR is 1.25x, as in the example calculation above, that means it can produce an amount equal to 1.25 times its debt obligation over the course of a year.

It’s important to know that in some cases, DSCR calculations will also include non-operating income. If you are comparing different investment options, make sure to apply consistent criteria for any calculations you use.

How Do Real Estate Investors Use DSCR?

Investors typically assess a borrower’s debt service coverage ratio before making a loan for a project. Many investors look for projects with a minimum DSCR.

If a borrower has a DSCR of less than one, they have a negative cash flow and will be unable to cover their debt obligations without drawing on outside sources. A DSCR that is just above 1 is better, but the borrower may still be vulnerable to minor declines in cash flow.

Some investors are willing to invest in properties with low debt coverage ratios if they see the potential to increase cash flow through increasing rents or units. In these cases, lending institutions may be willing to approve a loan even if the DSCR is below a stated minimum threshold.

While the debt service coverage ratio is not the only metric used during real estate projects, or even while applying for a commercial loan, it is still an important part of getting a loan approved. Investors should understand how this metric works and how it relates to a property’s performance so they are more prepared when buying a property.

The DSCR is not the only metric investors consider when trying to determine whether a firm will be able to repay its debts. Often, long-term debt issues contain amortization provisions that include sums comparable to the interest requirements. If a firm fails to meet the sinking fund requirement, they default and can be forced into bankruptcy.

If you want to more accurately measure whether a firm can repay its debts, you may want to calculate the fixed charge coverage ratio. This ratio accounts for earnings, taxes, fixed charges, and interests. The higher the fixed-charge coverage ratio, the more likely it is that the firm can cover all of its fixed charges, including debt payments.

Is There a Good Debt Service Coverage Ratio in Real Estate?

A good debt service coverage ratio depends on the industry, competitors, and the goals of the investor or lender. Many people consider a DSCR above 1.25 to be good in normal market conditions. Keep in mind that smaller, newer, and growing companies generally have lower DSCR expectations than more mature companies.

Generally, the higher the DSCR, the more secure the lender’s position is. You may want to look for a higher debt service coverage ratio is you are a more risk-averse investor.

Check Out the CEP Blog to Learn More About Real Estate Investing

To learn more about real estate investing terms and trends, including multifamily investments, we encourage you to check out the CEP blog or subscribe to our newsletter.