Alternative investments are any financial assets that fall outside the conventional investment categories of stocks, bonds, and cash.

-Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of their complex nature, lack of regulation, and degree of risk.

What Are Some Examples of Alternative Investments?

Alternative Investments include:

Private Equity or Venture Capital

Private Equity or Venture Capital is an alternative form of financing, away from public markets, in which investors directly invest capital into the company, usually early stage companies.

Hedge Funds

Hedge Funds are financial partnerships that use pooled funds and employ different strategies to earn active returns for their investors. These funds may be managed aggressively or make use of derivatives and leverage to generate higher returns.

Real Estate

Real Estate investments are opportunities to own land and improvements like a general office building, a multifamily apartment building, or a strip retail center.

Commodities

Commodities are investments made in things like grains, beef, oil and natural gas.

Other Tangible assets

Other Tangible Assets that are widely considered alternative investments include things like gold bullion, art, antiques, and other collectibles.

What are Common Attributes of Alternative Investments?

Most alternative assets are fairly illiquid, especially compared to their conventional counterparts. For example, investors are likely to find it considerably more difficult to sell an 80-year old bottle of wine compared to 1,000 shares of Apple Inc., due to a limited number of buyers.

Alternative investments typically have a low correlation with those of standard asset classes. This low correlation means they often move counter to the stock and bond markets. This feature makes them a suitable tool for portfolio diversification. Investments in hard assets, such as gold, oil, and real estate, also provide an effective hedge against inflation, which hurts the purchasing power of paper money.

How Do Alternative Investments Fit in a Portfolio?

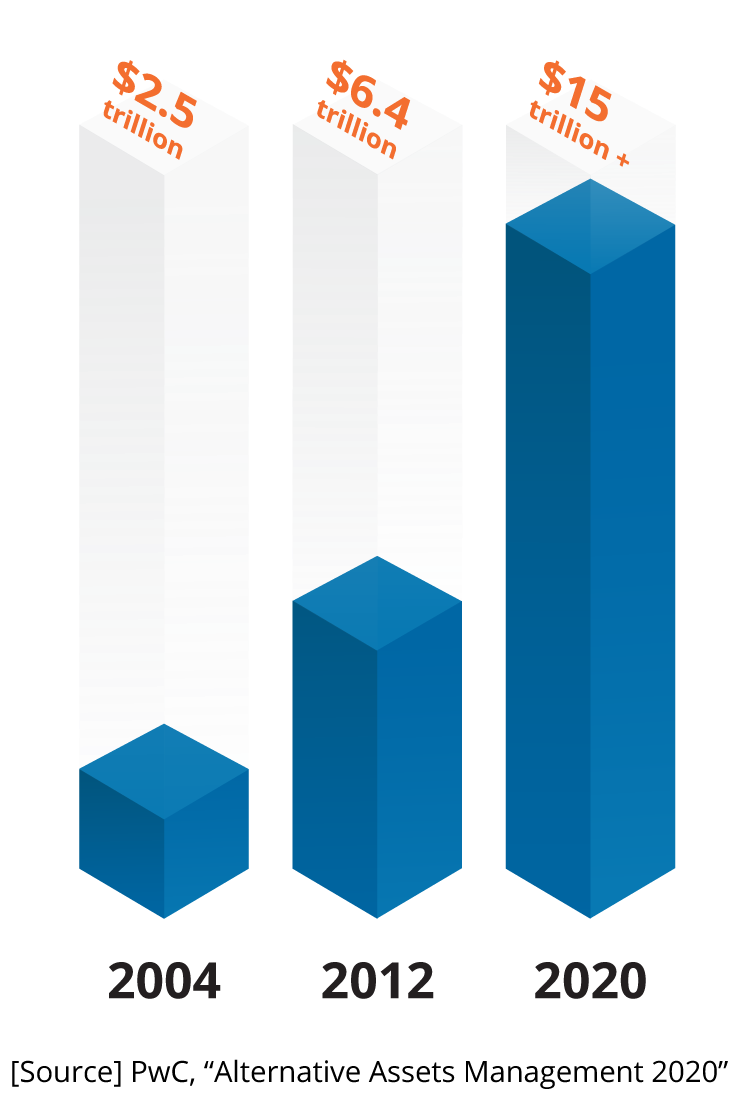

Interest in alternative investments has been steadily growing over the last two decades.

A Significant Trend: Alternative Investment Holdings Over Time

Alternative investments frequently surface as options for investors looking for ways to change their volatility exposure and potentially generate additional returns beyond holding stocks, bonds, and cash. For the right investor, alternative investments can be a compelling choice for building a diversified portfolio.

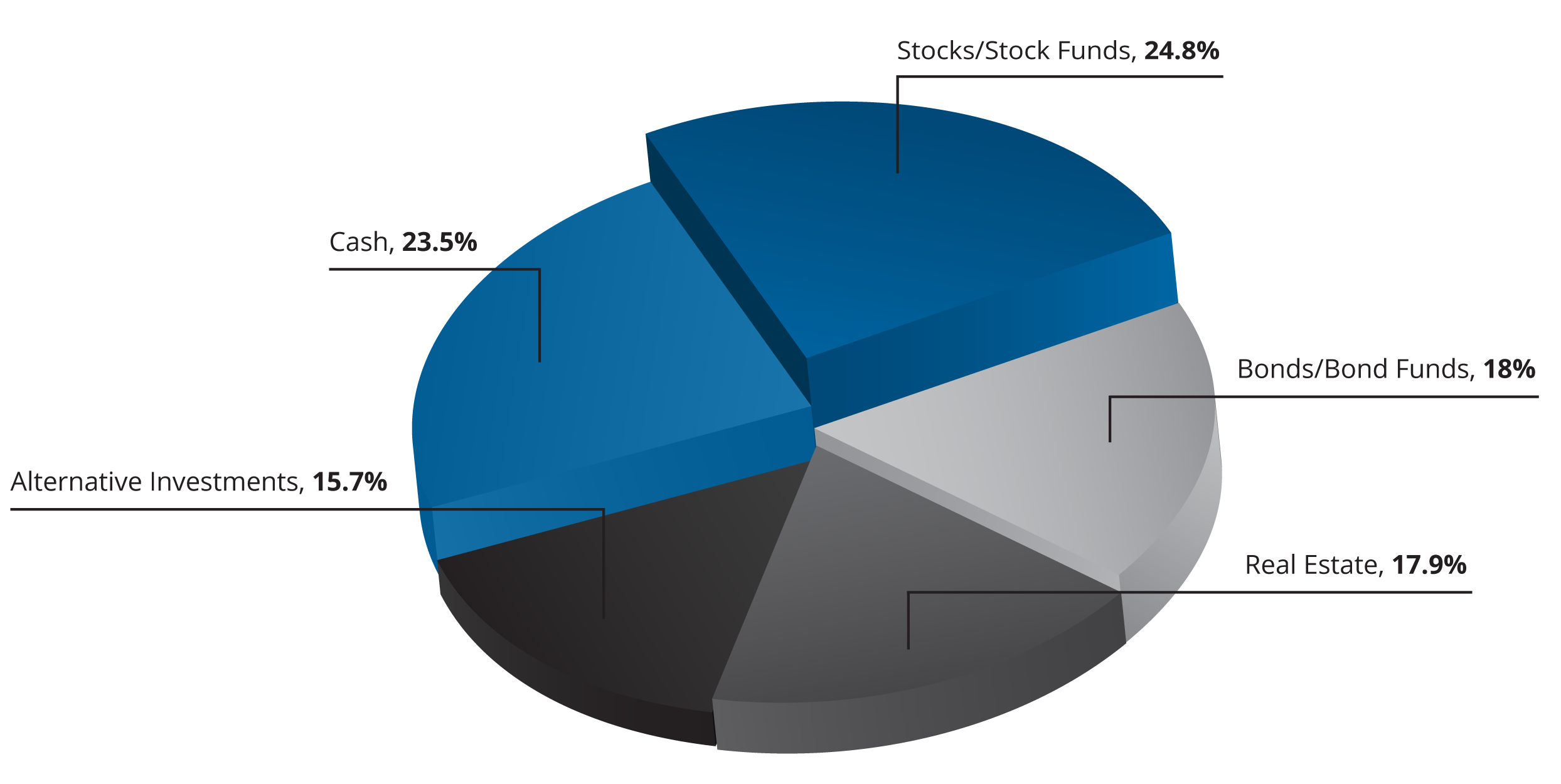

Accredited investors often hold 25%+ of their investment portfolio in alternative investments with real estate investments leading the way.

World Wealth Asset Allocation

The Pros and Cons of investing in Alternatives

The upsides of alternative investments:

Potential reduction in overall volatility. Since their performance is not correlated with the stock and bond markets, alternative investments may help to reduce overall volatility within a portfolio of traditional investments.

Diversification. Alternative investments typically help provide diversification across different markets, strategies, managers, and investment styles.

Potential for increased performance. Like any investment, the rate of return for alternative investments is not guaranteed but with the higher risk can come higher returns than you will find in the public markets.

The downsides of alternative investments:

Illiquidity. Alternative investments tend to be private, rather than public, and they are generally illiquid, so they may be difficult to exit and your money may be tied up for an extended period of time.

Lack of regulation. Alternative investments are not regulated and are not subject to reporting requirements. In addition, the underlying assets of alternative investments are often difficult to value, which leads to challenges in pricing and price transparency.

High minimum investments. Many alternative investments carry high minimum investments, and may not be available to all investors. In addition, alternative investments generally carry higher fees.

Complexity. Alternative investments are often complex instruments and may require a higher level of due diligence. If you are considering alternative investments, you also want to be sure that you research and understand the potential tax implications associated with them.

How to Invest in Alternatives

Private Equity/Venture Capital

There are many opportunities to explore and fund the next unicorn, including participation in angel investment clubs, venture capital funds, and debt and equity crowdfunding platforms. But be aware that most startups fail. CB Insights’ research shows only 1% of startups become unicorns.

Hedge Funds

There is no shortage of hedge fund managers that will invite accredited investors to invest in their fund. There are at least 16 common types of hedge fund strategies so investors usually pick a fund based on their belief in a given strategy.

Real Estate

Real estate is the largest class in the alternative investment arena. Here investors have many choices; They can invest in REITS, participate in a real estate investment fund or make direct investments in real estate through a sponsor who pools investor capital and purchases and operates the commercial real estate asset.

Commodities

Commodities trade in futures markets. So investors can buy contracts on specific commodities like oil or orange juice crops like the Duke Brothers did in the movie “Trading Places”.

Other Tangible Assets

Collectibles, art and other tangible assets are usually traded through auctions where rare items that have no common transaction value are bid on in an open forum and awarded to the highest bidder.

Is Real Estate the Right Alternative Investment for You?

For the right investor, real estate can be a great way to generate passive income and create long-term returns. And with the equity and bond markets facing alarming levels of volatility, it can also be a good diversifier in a managed portfolio. When stocks or bonds take a downward turn, directly owned real estate does not necessarily drop with it, thanks to its low correlation with those markets.

When considering adding real estate to your portfolio, it is important to be clear on your overall risk tolerance and investment strategy. For example, your goal might be cash flow to produce recurring income for living expenses. Or perhaps you’re looking for appreciation on capital and don’t mind the development risk associated with value add or opportunistic investments.

How Do You Invest in Real Estate?

One option would be to build a portfolio of directly owned real estate properties in various geographies and of various property types. This method would require a substantial amount of capital and requires a significant level of management.

Another alternative would be professionally managed private partnerships or investment funds. With this option, you can gain the expertise and scale of professional real estate managers and, through partial interests, the capital required is significantly less than trying to replicate this independently.

Alternative investments and specifically real estate alternatives have become the third leg of the investing stool (Stocks, Bonds and Real Estate) for accredited investors. CEP Multifamily has been helping investors diversify into real estate alternatives through the professionally managed private real estate partnerships we sponsor.

Our investors are able to boost overall returns through a healthy balance of tax advantage income and appreciation while diversifying away from stocks and bonds and the volatility of the public markets. For more information on investing in real estate alternatives visit us as at CEP Multifamily.