Commercial Real Estate Investing in a Tough Economy

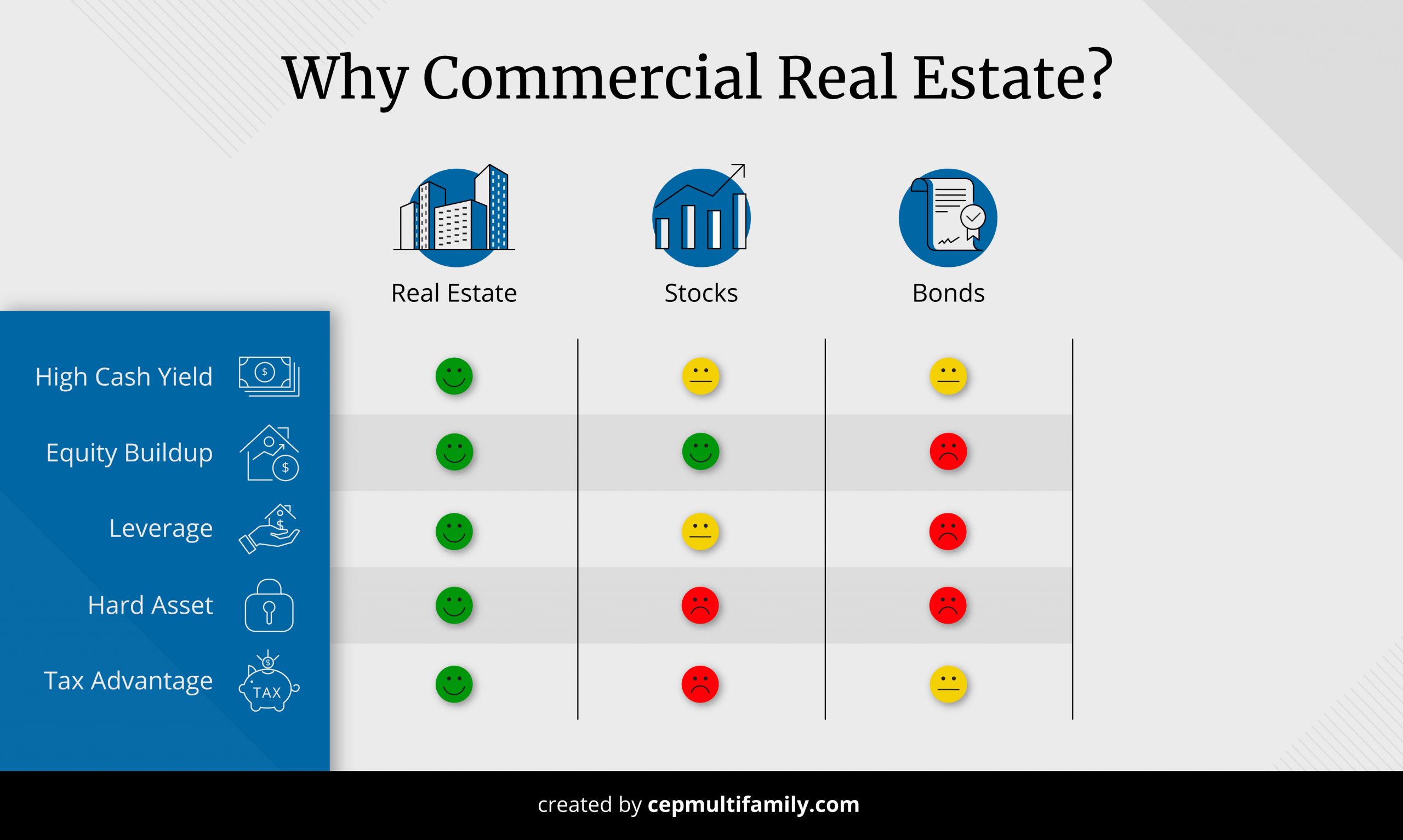

Making investments in commercial real estate assets that are uncorrelated to traditional equity or fixed income markets can help you meet your investment objectives. With equity markets peaking, and volatility ever-present, the time is now to diversify your investment portfolio by adding an allocation to commercial real estate.

The economic turbulence caused by the COVID-19 pandemic has hurt many sectors of commercial real estate. General office, retail, and hospitality have all been hit particularly hard, while multifamily is proving very resilient.

The Resilience of Multifamily Real Estate Investments

Multifamily properties, especially those located in the suburbs and secondary and tertiary markets (workforce housing), are staying full, with delinquencies holding under 10%. Housing is a basic human need and tenants tend to prioritize paying their rent to maintain their shelter. Plus, revenue in an apartment complex is derived from multiple leases which broadly spreads financial risk amongst lots of individual households all with different jobs and economic circumstances. This is in contrast to office, retail, or hospitality which has fewer tenants; therefore putting ownership in greater financial risk during this time.

Suburban workforce housing assets that are well operated are generating solid net income (cash flow) for their owners. Stable monthly revenue and no significant increase in expenses needed to operate in the pandemic result in positive net income which means stable distributions of cash flow to investors.

Real Estate and Liquid vs Illiquid Investments

While you can find strong yield from these investments, they have a different liquidity profile from the more traditional fixed income strategies. While you have to endure significant market volatility, fixed income investments are priced daily and are very liquid. They can be bought and sold in established markets. In contrast, CRE investments are considered illiquid. They should be considered as long term holds and they rarely have a secondary market available where you can trade the investment units. So, if you are in a position to park your capital for a few years, multifamily investments are a place where you can have a strong stable yield.

Finding the Right Multifamily Investment Opportunity

Finding opportunities to make investments in workforce housing can be elusive. It is difficult for most investors to amass the capital needed to acquire assets. And even if you have the capital to make outright purchases, few investors have the time or expertise to be an active owner. This is why investors are motivated to move a portion of their investment capital out of traditional stock market investments to make an allocation to multifamily investments. Investors can take a passive position (Limited Partner interest) in an investment opportunity sponsored by a private equity real estate investment firm.

CEP Multifamily focuses exclusively on sponsoring high yield investments in workforce housing in the Pacific Northwest. Accredited investors can make direct investments in the multifamily assets we sponsor. We invite you to register with us today to begin seeing multifamily investment opportunities from CEP Multifamily. We deliver high yield and solid risk adjusted returns for our investors. Join us today and start earning tax advantage passive income with CEP.