Real estate can be an excellent addition to an investment portfolio, especially for investors who are looking to diversify beyond stocks and bonds. People will always need a place to live, and there is a finite amount of land available to work with.

However, just like with other types of investments, you can’t assume that any one property will provide the return you are looking for.

It can be hard to decide whether a real estate investment is worth it. One of the most important pieces of information that can help you make a good decision is the expected return on investment.

What is Return On Investment?

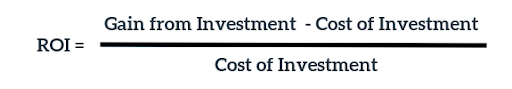

Return on investment (ROI) is a popular metric that investors and financial professionals use to estimate how profitable an investment will be. It’s a ratio that compares the gain from the investment to its cost, although it is usually expressed as a percentage.

ROI calculations are used with all kinds of investments, including real estate and stocks. Different factors will affect the ROI for different types of investments, but the basic formula is the same.

Why ROI Matters

While ROI is not always as easy to calculate as it may seem at first glance, it is still a relatively simple and easy-to-understand metric. Its simplicity has made it a very popular measure of profitability in many different settings.

Investors often use ROI calculations to evaluate investment opportunities and compare between similar properties. While the metric has its limitations, such as not considering the risk or the holding period of the investment, it’s still a fairly intuitive metric that many people prefer to use as they evaluate investments.

A disadvantage of ROI calculations is that they don’t take into account the length of time the investment is held. If you are comparing investments that will be or have been held for different amounts of time, you may want to use a different profitability measure, such as the internal rate of return (IRR).

How to Calculate Return On Investment

At first glance, the formula to calculate return on investment looks simple. It can be expressed like this:

However, multiple factors play into the gain from investment and cost of investment, which means calculating the return on investment for a property can be fairly complex. It’s not simply a matter of dividing rental income by the initial price you paid on your investment.

Here are a few pieces of information that are likely to factor into a property’s ROI:

- The initial value of the investment. ROI calculations depend partially on the value of the property or holding at the time the investment was made.

- The final value of the investment. If the value of a property increases, that increase will add to the investor’s wealth; if the value decreases, the investor has effectively lost money, though that loss is not realized until the investor sells the property. Many people take changing property values into account when calculating ROI.

- The cost of the investment. ROI is calculated relative to the initial price the investor paid to acquire it, which is not always the same as the initial value, especially in cases where a mortgage is involved.

- Rental and other income. The most significant factor in your ROI calculation, aside from the property value, is income. To calculate ROI, you will need to calculate the projected monthly income from rent payments and any other sources while taking into account the anticipated vacancy rate percentage.

- Maintenance and repair costs. Repairs can be costly and may eat into your returns, especially if you underestimated regular maintenance costs.

- Mortgage numbers. Mortgage payments and related costs will lower the amount of income you get to keep from the property. The loan terms, closing costs, down payment, and interest rates will all factor into your ROI.

- Other expenses. Property taxes, HOA dues, property management, utilities, and insurance can all factor into your final ROI.

To calculate the ROI of a property, subtract the initial value of the investment from the final value of the investment, add any income received (including rent), subtract any expenses (including maintenance, repairs, property taxes, and insurance), and divide the whole total by the cost of the investment. You can then multiply this number by 100 to express the ROI as a percentage.

If you own a rental property, you may want to use a calculator like this one to estimate the ROI of your property.

What is a Good ROI for Real Estate Investors?

Real estate, including commercial real estate, can provide some of the best risk-adjusted returns in the investing world. Between monthly cash flow from tenants, tax advantages, and appreciation over time, real estate is often a major source of wealth.

For most rental properties in the U.S., a 5 to 10% ROI would be an acceptable range. An excellent ROI may be above 10%. However, these numbers may change depending on your local real estate market and the level of risk you are willing to take on.

Be aware that properties that look great at first glance may come with hidden fees and expenses. It’s important to look at every source of income and every type of expense you can expect to pay when comparing the ROI on different properties.

Different types of real estate will create ROI in different ways. A multifamily apartment complex will provide cash flow primarily from rent payments, but some income may come in from additional sources such as guest parking and amenity usage payments. A single-family home will usually provide income from rent payments alone, and that income may be more vulnerable to vacancy and related challenges. A short-term rental property may not provide consistent income.

With a strong ROI, real estate can increase your wealth so you can save for a better retirement and build a legacy to leave to the next generation.

Learn More About Real Estate Investing From CEP

The CEP team has been successfully investing in real estate for four decades. We regularly share articles about common investing terms, practices, strategies, and trends on our blog and in our newsletter.

To learn more about real estate investing, including multifamily investments, we encourage you to check out the CEP blog or subscribe to our newsletter.