There are many metrics you can use to understand how well your investment is doing. One of the most popular metrics in real estate is cash-on-cash return, a relatively simple metric.

What is a Cash-On-Cash Return?

A cash-on-cash return, also known as a cash yield, is a metric commonly used in commercial real estate investing. It is a rate of return that calculates the cash income earned on cash invested in a property, generally on a pre-tax basis. In real estate transactions, it often measures the annual return the investor received on a property relative to the amount of mortgage paid in the same year.

Cash-on-cash returns are often used in real estate transactions, especially in transactions that involve debt. They are considered a relatively easy metric to understand, and they can be used to set a target for projected earnings and expenses.

There are major differences between the cash-on-cash return and other common return rate metrics:

- Return on equity vs. cash-on-cash return: The return on equity measures your cash flow against your equity in the investment, not your initial investment. Your equity will typically change from year to year, but your initial investment will not change. The return on equity will almost always decrease over the years, even if the cash-on-cash return stays the same.

- IRR vs. cash-on-cash return: The IRR measures the annualized return to an investor based on all net cash flows received during the duration of an investment, not just the return based on the pre-tax cash flow for a given year. The formula for the IRR is much more complex than the cash-on-cash return formula.

- ROI vs. cash-on-cash return: The ROI is typically calculated for the lifetime of the investment, while the cash-on-cash return only measures the return for a single year or period of time. Also, the actual cash return on investment will differ from the standard ROI in the same time period when debt is included in the transaction. Many investors consider cash-on-cash return to be the more meaningful analysis of an investment’s performance.

How Do You Calculate Cash-On-Cash Return?

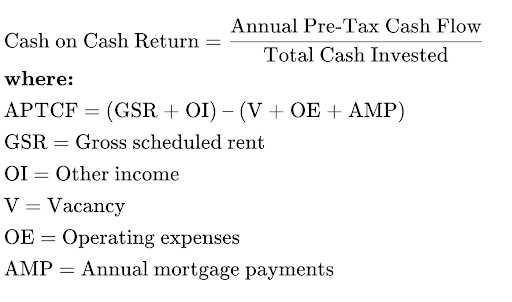

The formula for cash-on-cash return in a given year looks fairly simple at first glance:

However, there are many variables that go into the annual pre-tax cash flow portion of this equation. Your cash flow is based on the annual income you receive from the property (including rent) after subtracting operating expenses and mortgage payments. Some people like to include equity gains from principal payments as a form of income in this calculation.

For example, let’s say you purchase a $1 million property with a $100,000 down payment. You also pay $20,000 in insurance, closing costs, and maintenance out of pocket. After a year, you will have paid another $30,000 in loan payments with $5,000 going to the principal. You also expect to receive $50,000 in rent payments and have no vacancies. At this point, you plan to sell the property and expect to get $90,000 more than the price you purchased it for.

In this case, your annual pre-tax cash flow is ($50,000 + $90,000 + $5,000) – ($20,000 + $30,000) = $95,000, assuming you count your increased equity from principal payments as income. Your total cash investment is $100,000. According to the formula, your cash-on-cash return is forecast to be $95,000 / $100,000 = 0.95, or 95%.

If you choose not to count your increased equity from principal payments, your annual pre-tax cash flow is ($50,000 + $90,000) – ($20,000 + $30,000) = $90,000. As a result, you end up calculating a cash-on-cash return of 90%.

Most people do not consider appreciation when calculating the cash-on-cash return calculation until that appreciation is realized through a sale. In this example, if you do not sell the property, your pre-tax cash flow is forecast to be ($50,000 + $5,000) – ($20,000 + $30,000) = $5,000. The cash-on-cash return calculation will give you a much lower number, 5%, until you sell the property.

What is a Good Cash-On-Cash Return?

There is no general rule of thumb for a good cash-on-cash return. Your ideal return depends on your investment objectives and the market you are in, among other factors.

If you are investing in a growing or appreciating market, a property with a low cash-on-cash return may still be an excellent investment due to projected appreciation. An investor who prioritizes monthly cash flow may look for an 8 to 12% cash-on-cash return or more, while an investor looking for higher appreciation may prefer properties with a 5% cash-on-cash return or less.

What This Metric Really Tells You About Your Real Estate Investment

The cash-on-cash return can help you estimate future cash distributions. It’s a good way to estimate a percentage of profits relative to how much cash you put into the investment.

However, cash-on-cash return calculations do not give you a complete picture of an investment’s value. In rapidly appreciating markets, a large part of an investment’s appeal may be the potential to sell later for substantially more than you paid today. Expected appreciation typically is not included in cash-on-cash calculations, at least not until you sell and realize that appreciation.

Also, it’s important to remember that the cash-on-cash return is pretax. Your net return will be lower than the cash-on-cash return in any given year if you have to pay taxes on your returns.

How Important is Cash-On-Cash Return?

Cash-on-cash return is very important for investors because it makes it easier to determine which property to purchase and the best way to finance that property. It’s a quick way to compare between similar investment opportunities.

The cash-on-cash return can also give you a snapshot overview of how your existing investments are doing. Your return using this metric will increase if you begin receiving more income from the property (e.g. if you successfully raise rents on rental units in the property) or sell it for a higher value than you paid for it. Similarly, your return will decrease if you have increased expenses or vacancies.

Check Out the CEP Blog to Learn More About Real Estate Investing

To learn more about real estate investing terms and trends, including multifamily investments, we encourage you to check out the CEP blog or subscribe to our newsletter.