Tom has over thirty years of experience as a property manager, real estate advisor, and investor. In 1987, he co-founded Coast Property Management alongside his brother Shawn after identifying the need for a high performing, values-based property management company in the market. Coast has long since grown into The Coast Group, which is a vertically integrated, privately owned family of real estate companies encompassing property management, facility services, specialized construction, advisory, and investment companies. Today, The Coast Group is one of the region’s largest and most respected

real estate services firms of its kind as it is able to leverage the different companies' resources to provide the best possible returns for clients.

Built as an extension of their humble servant leader view of themselves, the Hoban brothers and their executive leadership teams have become synonymous with excellence, innovation, and reliability. Along the way, the brothers have been recognized for their professional accomplishments and work in the communities they serve, earning them the co-alumni of the year award from the University of Notre Dame alumni association and The Family Enterprise Institute’s Washington Family Business of the Year.

Over the years, they invited others who possessed complimentary if not superior talents to join them as partners and co-leaders in the Coast Group of Companies. In 2017, they formed The Hoban Family Office (HFO) to create a platform for innovation (Coast Innovation Center), talent development, and leadership in service to the Coast Group of Companies, their families and the communities they serve. It also serves as their charitable arm, with a focus on service to the poor and vulnerable and development of tomorrow’s leaders.

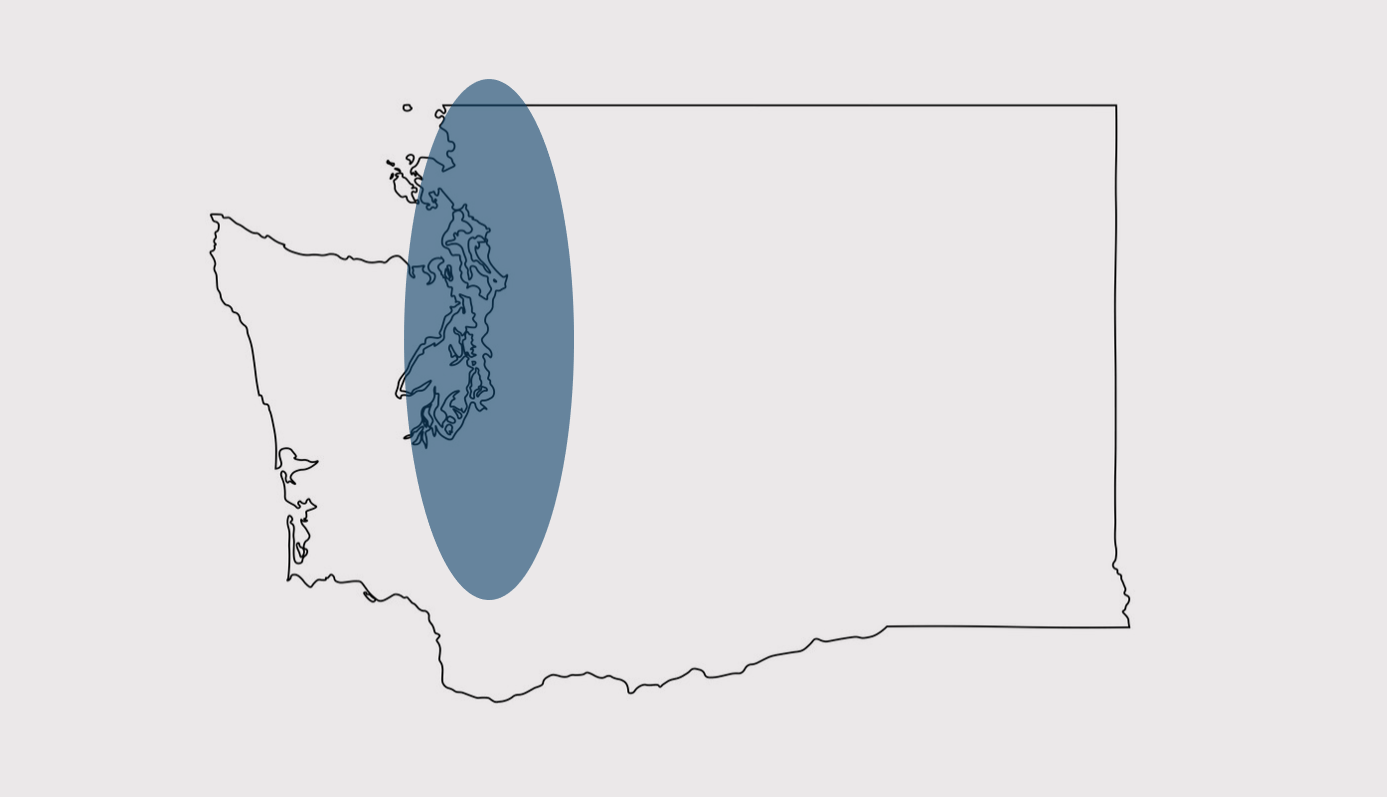

Tom leverages his vast network, engaging personality and refreshingly transparent approach into many venues, including his long-running column in the Herald Business Journal, as a freelance writer and as a guest speaker or lecturer all while serving on several boards or advisory functions, including Santa Clara University Real Estate School Advisory Board, Washington State University – Everett, University of Portland board of trustee’s, The Washington State Governor’s Affordable Housing Advisory Board, The

Commercial Broker’s Association of Puget Sound, Archbishop Murphy High School (Everett, WA), The Boys and Girls Clubs, chairman for the Snohomish County Airport Commission, The City of Everett

Economic Development Advisory Council, and others. The brother’s ventures together earned them two very prestigious awards: The Washington State Family Enterprise Institute’s Family Business of the Year

and The University of Notre Dame Alumni Association co-alumni of the year.

Tom graduated from The University of Notre Dame with a BA in Finance. A former coach, scoutmaster, and basketball referee, in his spare time today Tom continues to play recreational basketball, remains active in his church and enjoys time with his wife, two sons, and daughter on the Puget Sound.